Property Damages

We Can Evaluate Various Claims

Storm Damage

Hurricane, Wind, Rain

In South Florida, storm damage can be a common occurrence – a result of...

Learn More

Fire Damage

House, Kitchen, Smoke

As a victim of fire damage to your home or business, heartbreak as well...

Learn More

Theft/Vandalism

Break-In, Robbery, Damage

All property, commercial and residential, is at risk for vandalism and...

Learn More

Water Damage

Flood, Plumbing, Leaks

It is no secret that water damage is a common problem for residents and...

Learn More

Mold Damage

Leak, Fire Control, Storm

Mold infestation can cause significant property damage in homes and...

Learn More

Roof Damage

Shingles, Sheathing, Structure

Homeowners and business owners know the costs can mount quickly when...

Learn More

Storm Damage

South Florida storm damage is a common occurrence. Damage can be caused as a result of hurricanes, tropical storms, and even downpours. Storm damage is destructive to properties and can be distressing to its owners. This type of damage is made of two types, structural damage as well as property or inventory loss. Attaining the proper representation for your insurance claim following storm damage means hiring a public adjuster. The adjuster will advocate for you and your property. As experts in assisting clients in these matters so that you can get the maximum compensation for your loss.

As advocates, public adjusters are tenacious in obtaining an equitable settlement quickly, so you can quickly receive the funds needed to replace or repair damages. Hiring a public adjuster can be beneficial in more ways than one. While adjusters have the power and expertise to understand your insurance policy, they also know how any conditions within can have an effect on your settlement. Your adjuster will completely take charge and complete the entire process of filing a claim and reaching a solution.

Fire Damage

Fire Damage can be devastating because the loss is often great. To make matters worse the time to make a claim is often limited and it is extremely complex to navigate how to properly file a fire damage claim. Hiring a public adjuster will ensure you are provided proper representation to make sure this complicated claim is processed correctly. This is especially important with fire damage being that the claims are often for large amounts.

As with other property damage claims, a public adjuster has the knowledge and experience to understand not only the details of your policy but the nature of your damage. Using this knowledge, a public adjuster will make sure the damage is correctly assessed and the claim is correctly filed in a timely manner. A public adjuster will negotiate the proper settlement from your insurance company, work through any denials, and ultimately get you the funds as quickly as possible.

Theft/Vandalism

All property, from commercial to residential, is at risk for vandalism and theft. When your property is vandalized, damaged due to break-in, or you suffer a loss due to theft, there are likely a number of technicalities to be addressed when filing a damage claim with your insurance carrier. Skeptical insurance companies often question if there was vandalism or theft. It is on the property owner to be able to prove fowl play. A police report following the incident can help, giving an official statement of damages and loss, and helping to prove the claim is valid and truthful. It is important to know that if you find further damage or loss, you must contact the police so that your report can be updated.

An experienced public adjuster, on your behalf, will provide all the facts and evidence needed by your insurance company. This guarantees you can get the compensation you deserve quickly. Additionally, a public adjustor works throughout the claims’ process as your ally, ensuring you receive compensation for the losses you have acquired.

Water Damage

It is no secret that water damage is a common problem for residents and businesses in South Florida. Given the areas heavy rains, flooding often follows. Of course, nature is not the only culprit behind water damage, as leaks from appliances, roofs, sinks, and more can also cause water damage in your home or business. Following water damage, most home or business owners file a claim with their insurance carrier, expecting a fast and easy settlement to take care of damage and loss. The problem is many insurance companies offer considerably less than what is needed to cleanup and repair water damage, and others simply deny the claim.

That is why you need to first call a public adjuster when you sustain water damage to your home or business. A public adjuster can completely handle your insurance claim from start to finish. Professional and experienced, public adjustors have the knowhow to properly assess the damage to your property (including those unseen areas inside walls, beneath the roof, etc.) and ensure that you get a fair settlement. Working as a negotiator on your behalf, a public adjuster can effectively work with your insurance company to provide a complete settlement that will cover the cost of all damages sustained by water, which can be extensive.

Mold damage

Mold infestation can cause significant property damage in homes and businesses. Mold flourishes in damp, moist areas and can result in property damage as well as well as serious health issues. Once mold is detected, the costs for removal and remediation can mount quickly. Unfortunately, mold damage is common in South Florida as a result of the heat and humidity of our tropical environment. If you detect mold on your property, it is important to contact a public adjuster to assess the extent of the damage and file a claim for damage with your insurance carrier.

As an expert in the industry, a public adjuster understands the intricacies of making a claim for mold damage amid a mass of exclusions and limitations that may be in your insurance policy. Your public adjustor knows how to advocate on your behalf, defending your rights, and ensuring you get the maximum compensation for your property damages. The funds obtained will allow you to rid your property of the existing mold and begin the recovery process.

Roof Damage

When a roof needs repairs or a complete replacement, the price can be substantial. As the property owner, you want to ensure you get full compensation for all the damages. An experienced public adjuster can help take that burden away from you. When filing a roof damage claim, it is important to provide all of the correct documentation to have a smooth claims process. Because public adjusters know the ins and outs of preparing roof damage claims, you can feel at ease that it will be done promptly and correctly. This includes insured peril claims and roof leakage claims. No matter the type of claim, we help property owners recoup full compensation for the roof damage, in addition to losses for the interior of the property.

Insurance companies often take into consideration the age and condition of the policy owner’s roof when writing a policy. This allows for decreased compensation should roof damage occur. A public adjuster will help navigate the nuances of your particular policy agreement and negotiate on your behalf. Using a public adjuster is the only way to ensure the roof damage claim is handled correctly, argued by a seasoned negotiator, and resolved quickly so you can recoup the cost of your repairs and/or losses.

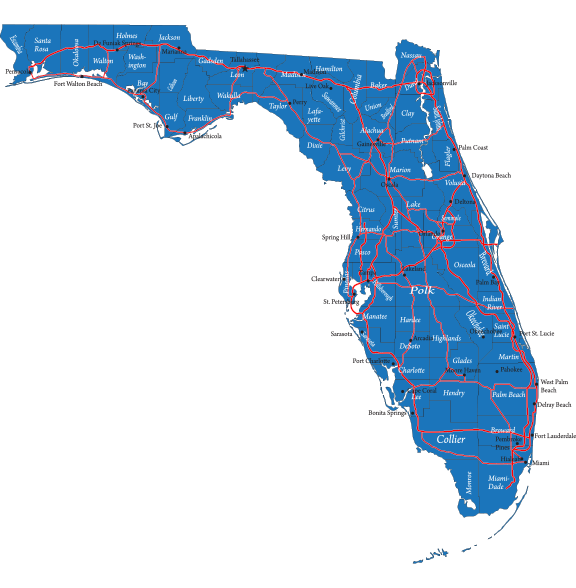

Servicing All of Florida

While I am based in Miami, my company and I service the entire state of Florida. Wether your in the Panhandle, Orlando, Jacksonville, Tampa, Naples or South Florida, we can help you.

Florida Panhandle

Tallahassee, Pensacola, Panama City, Destin, Mexico Beach, Crestview, Chipley and more!

Tampa Area

Tampa, Clearwater, Dunedin, Saint Petersburg, Oldsmar, Tarpon Springs, Bradenton and more!

Naples Area

Naples, Fort Myers, Estero, Bonita Springs, Golden Gate, Cape Coral, Captiva and more!

Jacksonville Area

Jacksonville, Atlantic Beach, Saint Augustine, Ponte Vedra, Orange Park, Lakeside and more!

Space Coast / Orlando

Orlando, Kissimmee, Sanford, Winter Haven, Merritt Island, Cocoa Beach, Melbourne and more!

South Florida

Broward County, Palm Beach County, Miami-Dade County, Fort Lauderdale and more!